However, interest rates for a countered home loan often tend to be greater than various other home mortgages. If you are taking into consideration a countered mortgage, you require to have sufficient cost savings to guarantee that settlements will certainly be lower despite a higher interest rate. If you put 20% down ($ 40,000) as well as finance the remainder with a 30-year fixed-rate standard home mortgage at 3.875% interest, you'll pay $752 a month in principal as well as interest. Your overall passion paid on your $160,000 finance would pertain to nearly $111,000 by the time your home loan is done. If you place 20% down ($ 40,000) on a 15-year fixed-rate home loan at 3.125% rate of interest, your regular monthly settlement would certainly be $1,115 and you 'd pay virtually $41,000 in total passion.

- VA car loans do not need a deposit or mortgage insurance policy, as well as closing costs are typically capped and also might be paid by the seller.

- A home mortgage begetter is an organization or individual that works with a consumer to finish a mortgage purchase.

- Popular with first-time customers, as well as everyone else in times of unpredictability (hello there Brexit!), is the set rate home loan.

- Balloon home loans last for a much shorter term as well as function a lot like an fixed-rate home mortgage.

- If your loan size exceeds the restrictions of your details mortgage program and also doesn't comply with their standards-- as is the case with a big financing-- it's thought about a non-conforming finance.

That stated, there are local limits that top the mortgage amount that you can be approved for. Oh, and also incidentally, USDA means United States Department of Farming. An essential component of understanding VA lendings is recognizing the concept of "entitlements." A privilege is just how much cash the VA will assure to loan providers in case you fail. Rephrase, it's just how much of your home mortgage is backed by the VA . The size of your entitlement will usually identify just how much house you can afford.

Relevant Terms

Interest-only home loans are, for want of a better means of putting it, the odd one out on our list. While, as discussed above, a lot of mortgages function around the repayment principal, interest-only home loans run in an entirely various fashion. What are conventional car loans and exactly how do they compare to various other finance choices? Right here's just how you know whether a traditional car loan is best for you. Yet there's a kind of home mortgage that does the contrary-- the reverse home mortgage.

Pros Of Fixed

Mortgage prices can differ commonly relying on the kind of product and the certifications of the applicant. Home mortgages are available in a range of types, consisting of fixed-rate and also adjustable-rate. You have to fulfill specific earnings demands as well as the building must be in one http://martingvit529.bearsfanteamshop.com/the-fed-s-newest-step-will-certainly-send-loaning-prices-greater of the qualified areas. Your revenue needs will differ relying on the county you stay in. VA loans don't require PMI, however they do call for a 2.15% in advance funding charge. There are many elements that will certainly figure out how much you obtain accepted for, one of the primary ones is just how much of an assurance you're eligible for.

Every lender is different, as well as it is very important to comparison store to discover the very best terms that fit your financial resources. From the brick-and-mortar financial institution and also lending institution in your area to online-only home loan business, there is a large range of options to pick from. Check out Bankrate's lender evaluations of several of the leading names in home loans, as well as follow this overview to discover the best lender. If you are planning to remain in your residence for a minimum of five to seven years, and also intend to stay clear of the possibility for adjustments to your regular monthly payments, a fixed-rate home loan is right for you. They might be for larger residences, or they could be used to borrowers with substandard credit scores. Some non-conforming lendings are created for those that have undergone significant economic catastrophes such as a personal bankruptcy.

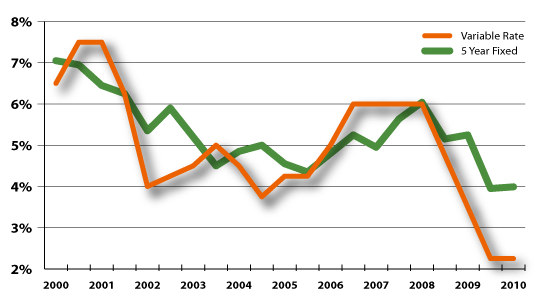

Home mortgage loan providers will consider your revenue and possessions to determine the total loan amount you can afford to pay back. When computing your allocate your monthly home mortgage repayment, consider the major quantity, rate of interest as well as taxes, home mortgage insurance, energies and any type of house owner's fees. Partial or entire down payment to avoid spending for home mortgage insurance policy; financing big section of high-end house acquisition to make sure that the remainder can be covered with a lower-rate conforming lending. Unlike fixed-rate choices, adjustable-rate mortgages have variable rate of interest.