The minimum repayment level is usually lower than the rate of interest just repayment. The alternative to make a minimal payment is normally available only for the first numerous years of the lending. To minimize the risk, lots of home loan producers market most of their home loans, especially the home mortgages with dealt with rates. If you are taking into consideration an ARM, you must run the numbers to figure out the worst-case situation. If you can still manage it if the mortgage resets to the optimum cap in the future, an ARM will certainly save you cash on a monthly basis. Ideally, you need to utilize the cost savings compared to a fixed-rate home loan to make extra major payments monthly, so that the complete funding is smaller sized when the reset happens, additionally reducing costs.

- They are, however, transforming a lot more to variable-rate mortgages, which offer reduced prices.

- With this alternative, you pay just the passion for a defined time, after which you start paying both primary as well as rate of interest.

- Your mortgage reset date can occur monthly, quarterly, every how to use a timeshare year, every three years, or every five years, depending on the type of financing you get.

- After that the rate of interest changes every 6 months for the remaining twenty years.

- The distinction of time between the taken care of rate as well as flexible rate durations are often expressed over one another.

ARMs accounted for 49.7% of the marketplace in their heyday back in 2005. They might never be that prominent again, partly because rates of interest are at historical lows, as well as due to the fact that ARMs are complicated economic tools to comprehend. 5-year ARM, for example, your initial rates of interest is secured for 5 years prior to it can alter. A great deal of customers are worried that if they get an ARM mortgage, the price might ultimately spiral out of control once it begins changing. That's an actual concern, particularly if you end up having the home longer than you expect. To fight this, you can re-finance into a fixed-rate lending if you certify.

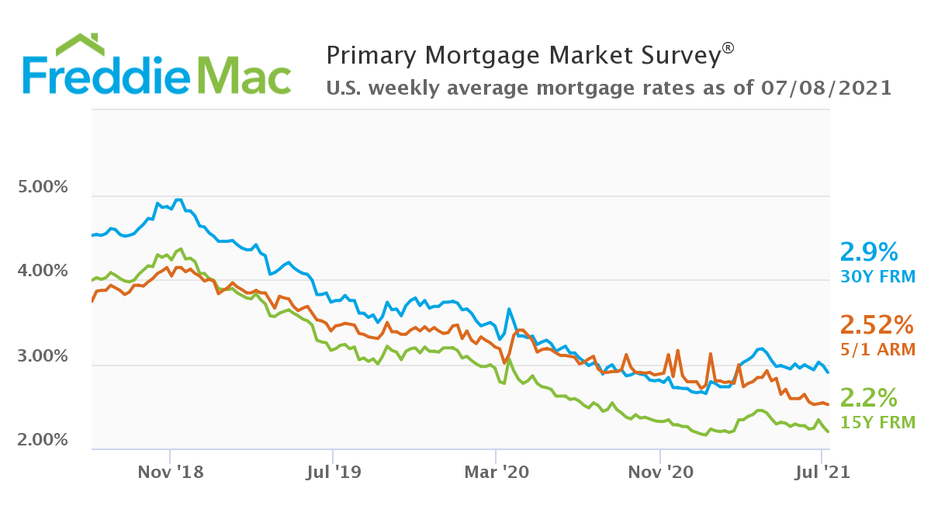

What Are Todays Arm Home Loan Prices?

To get even more accurate as well as individualized outcomes, please call to talk to among our home mortgage professionals. You can pursue re-financing your ARM right into a fixed-rate mortgage to lock in much more security than an ARM can use. An ARM can be a smart choice if you're planning to pay off the loan completely, or sell your house, before the change period kicks in. Each variable-rate mortgage has a cap that restricts just how much the rate of interest can alter or down at each change day and over the life of the lending.

Rate And Settlement Caps

Investopedia needs writers to utilize key resources to sustain their work. These include white papers, federal government data, original reporting, and also meetings with market specialists. We additionally reference initial research study from other trusted publishers where appropriate. You can discover more about the criteria we comply with in creating precise, objective content in oureditorial policy. Sign Up NowGet this supplied to your inbox, and also much more information regarding our services and products.

Despite where you are in the residence buying and financing procedure, Rocket Home mortgage has the write-ups and also sources you can depend on. A vital benefit of an ARM is that the first rate is commonly less than a fixed-rate home loan, which makes monthly repayments a lot more budget friendly. Under the policies, the rates of interest can be altered every three years, and also might rise no more than 5 percentage factors over the initial APR life of a https://marioqzqb.bloggersdelight.dk/2022/06/12/20-steps-you-can-take-to-grow-your-home-mortgage-business/ 30-year home mortgage, or be lowered without limit. One of the most significant dangers ARM debtors encounter when their financing readjusts is repayment shock when the monthly home mortgage payment increases considerably due to the rate change.

" If you are extending to manage the mortgage, this is most likely a risk you need to not take. The truth is, you could not also identify today's ARMs, particularly if you were one of those who obtained sucked right into a flexible home loan back in 2005. At that time, prepayment charges as well as unfavorable amortization were "fine print" components of ARMs and also caused tragic results for consumers. That's a decent revival after crash landing at just 2.8% of the marketplace in December of 2009.

Below are some terms you ought to know with if you intend to go with an ARM. ARMs can make good sense for clients who know they will be relocating in the future Learn more here or they know they will be paying off the financing in a few years. Numerous or all of the products featured right here are from our companions that compensate us. This may influence which products we blog about and also where and also exactly how the item appears on a web page. Although the authors attempt to supply reliable, beneficial information, they do not guarantee that the info or other material in this paper is accurate, present or suitable for any particular purpose.

Arm Terms

Likewise adding to the turnaround is the truth the borrowing industry is providing more palatable variations of the product to customers. Today's "hybrid ARMs" provide a break on interest and a fixed repayment quantity for the introductory duration prior to returning to adjustable rates at the 3, 5, 7 or 10-year mark. But also for specific buyers - particularly those expecting to relocate again in a couple of years - they're a wonderful product. If you're a regular property buyer seeking a conventional mortgage from a mainstream loan provider or cooperative credit union, you owe it to yourself to a minimum of check them out. As rate of interest decrease, there often tends to be a constricting of the return curve. This obtains a bit technical, yet generally the return curve handle the difference in between fixed- and adjustable-rate mortgages.