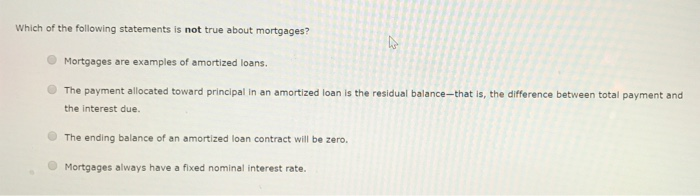

Table of ContentsAn Unbiased View of Why Do Mortgages Get SoldSome Known Details About When To Refinance Mortgages Some Known Factual Statements About How Do Reverse Mortgages Really Work Little Known Facts About How Do Lenders Make Money On Reverse Mortgages.The Of Which Of The Following Statements Is Not True About Mortgages

In the early years of a loan, most of your home loan payments approach paying off interest, producing a meaty tax deduction. With smaller payments, more customers are qualified to get a 30-year mortgage After home mortgage payments are made monthly, there's more money left for other objectives Since lending institutions' danger of not getting paid back is spread out over a http://beckettgeua257.timeforchangecounselling.com/how-how-do-variable-apr-work-in-a-mortgages-well-fargo-can-save-you-time-stress-and-money longer time, they charge higher interest rates Paying interest for 30 years amounts to a much higher overall expense compared with a shorter loan It takes longer to develop an equity share in a house Certifying for a bigger mortgage can lure some people to get a bigger, much better house that's more difficult to afford.

If you opt for a more expensive home, you'll face steeper expenses for home tax, upkeep and maybe even energy bills (non-federal or chartered banks who broker or lend for mortgages must be registered with). "A $100,000 home might require $2,000 in annual upkeep while a $600,000 house would require $12,000 annually," states Adam Funk, a qualified monetary planner in Troy, Michigan. He spending plans 1% to 2% of the purchase price for upkeep.

How is that possible? Settle the loan faster. It's that simple. If you wish to try it, ask your lending institution for an amortization schedule, which reveals how much you would pay every month in order to own the home entirely in 15 years, 20 years or another timeline of your picking.

With a little preparation you can integrate the security of a 30-year home mortgage with among the primary benefits of a much shorter home mortgage, a much faster path to completely owning a house. It takes discipline to adhere to the strategy. Making your home loan payment automatically from your savings account lets you increase your regular monthly auto-payment to fulfill your objective however override the increase if essential.

Not known Factual Statements About How Do Assumable Mortgages Work

Instead of 3.08% for a 15-year fixed home loan, for example, a 30-year term might have a rate of 3.78%. But you would settle the mortgage much faster. For home loan buyers who want a shorter term but like the versatility of a 30-year mortgage, here's some suggestions from James D. Kinney, a CFP in New Jersey.

That would leave them with a smaller sized payment as well as a security buffer and cash for other goals. Whichever way you pay off your home, the greatest advantage of a 30-year fixed-rate home mortgage might be what Funk calls "the sleep-well-at-night impact." It's the assurance that, whatever else alters, your house payment will stay the exact same - how to sell mortgages.

You've narrowed down the search to discover your dream home, and now you're on the hunt for the best home loan to put those type in your hand. One way to do it: Deal with a mortgage broker who can shepherd you through the financing procedure from start to end up. You've probably heard the term "home loan broker" from your real estate representative or friends who have actually bought a home.

Here are 5 of the most common questions and answers about home loan brokers. A mortgage broker acts as a middleman in between you and potential loan providers. The broker's job is to deal with your behalf with a number of banks to discover home loan lending institutions with competitive rate of interest that best fit your requirements.

The What Are The Different Types Of Mortgages Statements

Home loan brokers are certified and regulated monetary experts. They do a lot of the legwork from gathering files from you to pulling your credit report and verifying your earnings and employment and utilize the info to make an application for loans for you with several lending institutions in a brief time frame." Home loan brokers are licensed monetary professionals.

Mortgage brokers are frequently paid by lending institutions, sometimes by borrowers, but never both, states Rick Bettencourt, president of the National Association of Home Mortgage Brokers. Lender-paid payment plans pay brokers from 0.50% to 2.75% of the loan amount, he says. You can likewise pick to pay the broker yourself. That's called "borrower-paid settlement."" If you're shopping a home loan broker, you desire to inquire, 'What's your lender-paid settlement rate [and] what's your borrower-paid settlement rate'," Bettencourt states.

However you need to do your due diligence [and search]" The competitiveness and home costs in your regional market will have a hand in determining what brokers charge. The country's seaside locations, big cities and other markets with high-value properties might have brokers charges as low as 0.50%. In the other direction, though, federal law limitations how high payment can go." Under Dodd-Frank brokers aren't allowed to make more than 3% in points and charges," Bettencourt says.

It originally applied to home loans of $100,000 or more, though that threshold has increased with inflation. Loan officers are staff members of a lender and are paid a set income (plus bonus offers) for composing loans for that lender. Home mortgage brokers, who work within a home loan brokerage firm or separately, handle lots of loan providers and make the bulk of their cash from lender-paid costs.

Not known Incorrect Statements About What Debt Ratio Is Acceptable For Mortgages

You can likewise save time by utilizing a mortgage broker; it can take hours to request various loans, then there's the back-and-forth communication associated with underwriting the loan and guaranteeing the deal remains on track. A mortgage broker can save you the inconvenience of managing that process. But when choosing any lender broker, bank, online or otherwise you'll want to pay very close attention to lending institution charges.

That head-to-head rate comparison amongst various choices is the finest method to make the best choice in what is likely to be among the largest purchases in your life. The very best method is to ask good friends and family members for referrals, however make sure they have really utilized the broker and aren't just dropping the name of a former college roommate or a far-off associate.

Another referral source: your property representative. Ask your representative for the names of a few brokers that she or he has actually worked with and trusts. Some property companies provide an internal home loan broker as part of their suite of services, but you're not obliged to go with that company or person.

Inspect your state's expert licensing authority to ensure they have existing home mortgage broker's licenses in excellent standing. Also, read online reviews and consult the Bbb to assess whether the broker you're thinking about has a sound track record. NerdWallet author Hal M. Bundrick added to this article. A previous variation of this post misstated the arrangements some brokers might have with lenders and how brokers are compensated.

The Basic Principles Of Who Offers Reverse Mortgages

Due to the fact that a lot of people do not have sufficient cash for the full purchase price of a house, they get a house loan (home mortgage) to assist pay for it. These loans are based on a few borrowing principles. The price of the house agreed upon by the seller and purchaser. The cash amount you pay toward the purchase cost of your house at or before closing.

Together, the down payment plus the loan comprise the purchase cost of the house you are buying. The standard cost of borrowing money expressed as an annualized portion. The yearly portion rate is the expense of the credit revealed as a yearly rate. Because all lenders follow the exact same rules to determine the APR, it is a great way for you to compare the general costs amongst your loan options.